Artificial Intelligence (AI) is revolutionizing the financial services industry. From transforming operations to enhancing customer experiences and driving significant cost efficiencies -it is everywhere. As of 2024, the AI in finance market is valued at $38.36 billion and is projected to reach $190.33 billion by 2030, growing at an impressive 30.6% compound annual growth rate (CAGR). This rapid adoption underscores AI’s pivotal role in reshaping financial services.

Table of Content

Here is a comprehensive guide on how AI for finance is creating competitive advantages. What implementation of AI for finance actually looks like. And why financial institutions that delay adoption risk falling dramatically behind.

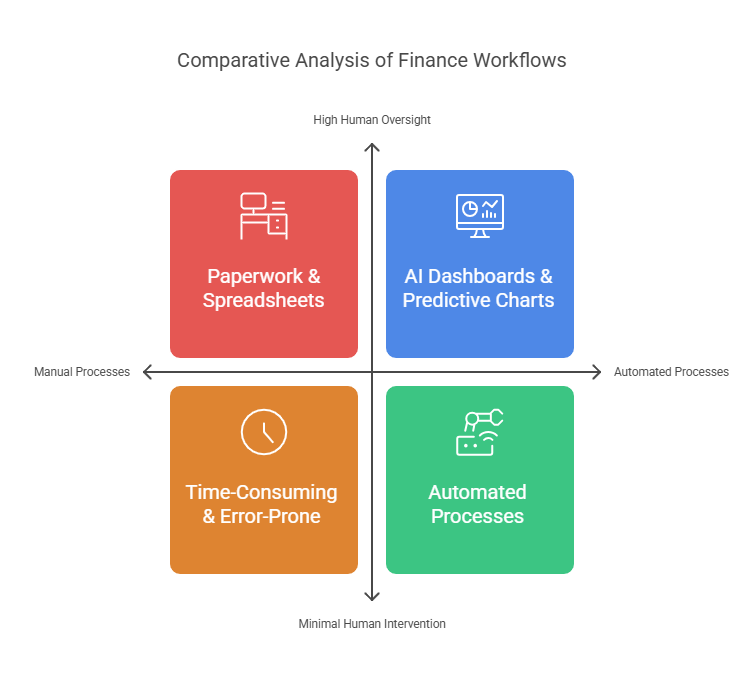

Artificial intelligence in finance refers to the deployment of advanced algorithms and machine learning models. Basically, it analyzes vast datasets, recognize patterns, and make decisions with minimal human intervention.

Unlike traditional software that follows pre-programmed rules, AI systems continuously learn and adapt. These systems power everything from the chatbot helping customers check their account balance to sophisticated models detecting unusual transaction patterns that human analysts might miss.

Financial institutions across the spectrum—from global banks and insurance giants to boutique investment firms and fintech startups—now integrate AI into their core operations. The technology serves everyone from CFOs seeking accurate forecasts to risk managers identifying emerging threats before they materialize.

Traditional credit models relied on limited data points like credit history and income. AI-powered underwriting analyzes thousands of alternative data signals—from payment patterns to social media footprints—to assess creditworthiness more accurately.

This expanded analysis enables lenders to approve loans for previously “invisible” applicants who lack extensive credit histories. One major online lender reported a 27% increase in approval rates with no corresponding increase in defaults after implementing AI models.

For small businesses, AI underwriting has slashed loan decision times from weeks to minutes. The technology examines cash flow patterns, invoice history, and even local economic indicators to make nuanced lending decisions at scale.

Financial fraud costs institutions billions annually, but AI systems now flag suspicious activities with remarkable precision. These systems analyze transaction patterns across millions of accounts in real-time, identifying anomalies that would be impossible for human analysts to spot.

AI reduces false positives in fraud detection by up to 70%, allowing security teams to focus on genuine threats rather than legitimate transactions mistakenly flagged as suspicious.

For anti-money laundering compliance, AI systems connect disparate data points to reveal hidden relationships between accounts and entities. This network analysis has proven particularly effective at identifying sophisticated laundering operations that deliberately work across multiple institutions.

AI-powered virtual assistants now handle 67% of routine customer inquiries at leading banks, providing instant responses regardless of time or day. These systems understand natural language, recognize customer emotions, and seamlessly escalate complex issues to human representatives.

Several major financial institutions report customer satisfaction increases of 35% after deploying conversational AI. The technology excels at delivering consistent information while eliminating wait times.

Beyond simple queries, advanced financial chatbots now help customers analyze spending patterns, set savings goals, and receive personalized financial advice based on their unique circumstances—democratizing financial planning for millions.

Investment firms deploy sophisticated machine learning models that analyze market signals across global exchanges in microseconds. These algorithms identify arbitrage opportunities and execute trades faster than any human trader could possibly react.

AI-powered robo-advisors have democratized investment management, providing algorithm-based portfolio services at a fraction of traditional costs. Assets under management by these platforms grew 43% in 2023 alone.

For institutional investors, AI systems now analyze alternative data sources—from satellite imagery of retail parking lots to social media sentiment—to gain insights before they appear in traditional financial statements or news.

CFOs increasingly rely on AI for more accurate financial forecasting. These systems process historical performance data alongside external economic indicators, competitive intelligence, and even weather patterns to project future performance with unprecedented precision.

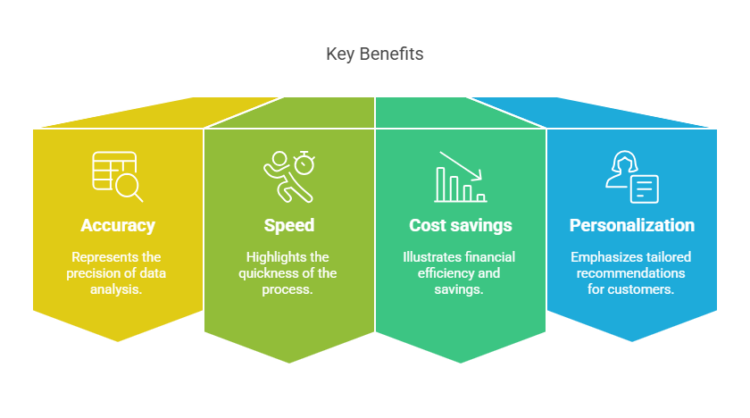

AI reduces forecasting errors by an average of 38%, allowing finance teams to make more confident decisions about capital allocation and investment priorities.

For risk management, artificial intelligence monitors thousands of risk factors simultaneously, creating early warning systems for everything from liquidity concerns to emerging market volatility. The technology has proven particularly valuable for stress-testing portfolios against scenarios too complex for traditional models to simulate.

Financial institutions implementing AI report error reductions of 29-46% across various processes. The technology eliminates human inconsistencies while processing vastly more information than traditional analysis methods.

A global bank recently automated 87% of its reconciliation processes using AI, reducing a task that previously required 140 employee-hours daily to just 18 hours. This efficiency allows skilled finance professionals to focus on strategic activities rather than repetitive tasks.

Traditional financial decisions often relied on quarterly or monthly reviews. AI systems assess risk, identify opportunities, and make recommendations continuously as new data arrives.

This capability has proven particularly valuable in lending, where AI-powered lenders now provide loan decisions in minutes rather than days. For trading desks, algorithms make thousands of portfolio adjustments daily based on real-time market conditions.

Financial institutions implementing comprehensive AI strategies report operational cost reductions between 22-28% across affected departments. The technology automates data collection, validation, and basic analysis that previously required extensive manual effort.

For customer service operations, each AI-handled interaction costs approximately 1/10th the price of a human-handled call. One regional bank reported annual savings exceeding $4.2 million after deploying conversational AI across its customer support channels.

AI enables financial services to shift from segment-based to truly individualized experiences. Systems analyze each customer’s unique behavior patterns to provide hyper-relevant recommendations and preemptively address likely needs.

Leading banks now use AI to predict when customers might need specific products—like offering pre-approved credit limit increases before major purchases or suggesting refinancing options when interest rates favor the customer.

Personalization extends to communication channels as well. AI analyzes customer preferences to determine whether they prefer text messages, app notifications, emails, or calls—and when they’re most likely to engage with each.

Regulatory compliance costs financial institutions billions annually, but AI significantly reduces this burden. Machine learning systems automatically flag transactions requiring additional scrutiny while maintaining comprehensive audit trails for regulatory review.

For complex regulations like GDPR or AML directives, AI ensures consistent application of rules across thousands of daily transactions. This consistency reduces both compliance costs and regulatory penalties.

Risk detection systems now identify subtle pattern changes that often precede major issues. Several institutions credit AI early warning systems with preventing significant losses during recent market volatility events.

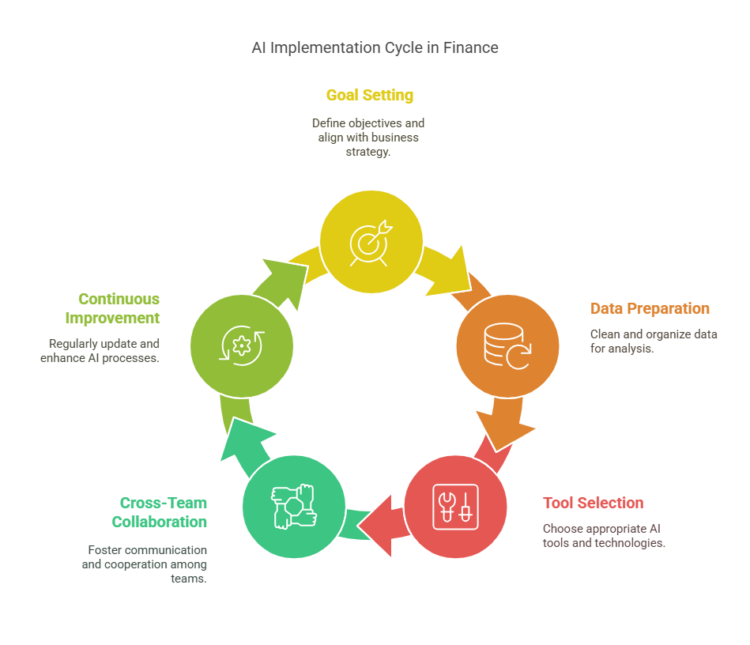

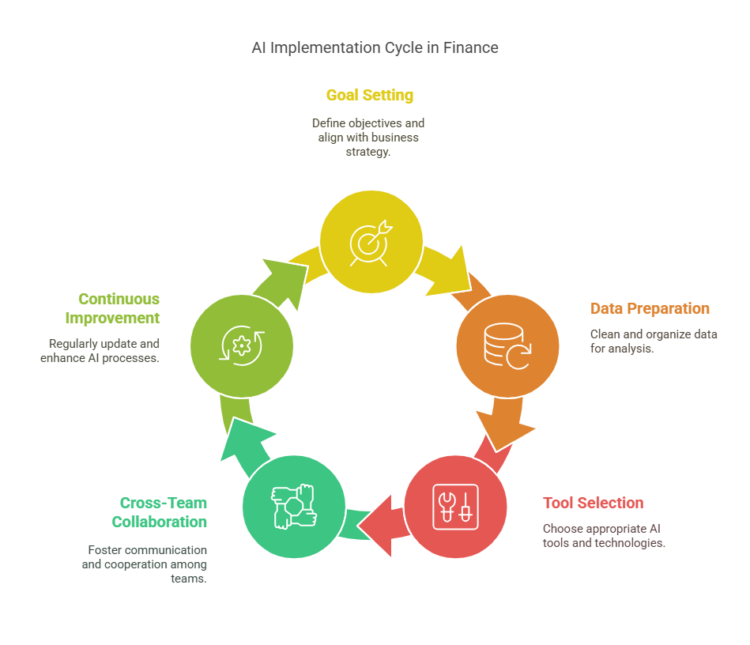

Successful AI implementation begins with clearly defined business objectives. Rather than adopting AI for its own sake, identify specific problems where the technology offers measurable advantages.

Prioritize use cases based on potential impact, implementation complexity, and alignment with organizational capabilities. Many institutions find that starting with process automation or enhanced analytics offers the quickest wins.

Document concrete success metrics before beginning. Whether you’re aiming for cost reduction, improved accuracy, or enhanced customer experience, these metrics will guide development and demonstrate ROI.

AI systems are only as good as the data they train on. Audit existing datasets for completeness, accuracy, and potential biases before beginning any AI initiative.

Financial data requires special consideration regarding privacy regulations like GDPR and CCPA. Implement robust anonymization processes and ensure compliance with all relevant data protection laws.

For many institutions, data preparation represents 60-70% of the total AI implementation effort. This investment pays dividends in model accuracy and reduced regulatory risk.

The AI tooling landscape offers options ranging from specialized fintech solutions to general-purpose machine learning platforms. Your selection should align with your institution’s technical capabilities and specific use cases.

Consider build-versus-buy decisions carefully. While custom solutions offer maximum flexibility, they require significant expertise. Conversely, pre-built solutions deploy faster but may offer less differentiation.

Evaluate vendor claims rigorously, particularly regarding financial domain expertise. Request case studies specific to your intended applications and speak with existing customers in similar institutions.

Successful AI implementation requires close collaboration between finance experts who understand the business context and technical teams who implement the solutions.

Create cross-functional teams with clear ownership and decision rights. Several institutions report success with “translator” roles—individuals with both financial and technical knowledge who bridge communication gaps.

Document domain knowledge explicitly. The subtle expertise that experienced financial professionals possess must be captured systematically to inform AI model development.

AI implementation isn’t a one-time project but an ongoing process. Establish monitoring systems that track both technical performance (like model accuracy) and business outcomes (like cost savings or customer satisfaction).

Plan for model drift—the gradual degradation of AI performance as market conditions change. Implement regular retraining schedules and validation processes.

Create clear escalation procedures for when AI systems produce unexpected results. Human oversight remains essential, particularly for high-stakes financial decisions.

The complexity of AI features dramatically impacts development costs. Basic implementations like rule-based chatbots might start at $50,000-$100,000, while comprehensive solutions with advanced capabilities can exceed $1-2 million.

Natural language processing capabilities add significant complexity, particularly for financial terminology. Similarly, predictive models for risk assessment or fraud detection require substantial expertise to develop and validate.

Integration requirements with existing systems often represent 30-40% of total project costs. Legacy financial systems frequently require custom connectors and extensive data transformation processes.

Custom-built solutions offer maximum control but come with higher upfront costs and longer development timelines. Most institutions spend 8-18 months developing comprehensive custom AI systems.

SaaS and platform-based approaches significantly reduce implementation timelines and initial investment. These solutions typically operate on subscription models ranging from $50-$250 per user monthly, depending on capabilities.

Hybrid approaches—combining pre-built components with custom elements—often provide the optimal balance between customization and speed-to-market.

AI development requires specialized talent commanding premium compensation. Data scientists with financial domain expertise typically command salaries 30-40% higher than their counterparts in other industries.

Geographic considerations impact development costs substantially. While offshore development can reduce hourly rates by 40-60%, communication challenges and domain knowledge gaps often offset some savings.

Ongoing maintenance and optimization typically require 15-25% of the initial development cost annually. This includes model retraining, performance monitoring, and adaptation to changing regulations.

Regulators increasingly demand transparency in algorithmic decision-making, particularly for credit and insurance decisions. Explainable AI models that clearly articulate their reasoning will soon become mandatory.

Leading institutions already implement “glass box” approaches where AI recommendations include supporting evidence and confidence levels. This transparency builds both regulatory compliance and customer trust.

Model validation teams now include experts specifically focused on algorithmic fairness and bias detection. These specialists ensure AI systems make decisions based on relevant financial factors rather than protected characteristics.

The convergence of AI and blockchain technologies promises to solve persistent challenges in financial services. Smart contracts with embedded AI capabilities enable self-executing agreements that adapt to changing conditions.

Several banks have already deployed blockchain-AI hybrids for cross-border payments, reducing settlement times from days to minutes while automatically detecting suspicious transaction patterns.

For asset management, these combined technologies enable unprecedented transparency and efficiency in transactions while maintaining robust security.

The next frontier of AI in finance extends beyond reacting to events to actively predicting customer needs. Leading institutions now anticipate life events that drive financial decisions—from home purchases to retirement planning.

Hyper-personalized experiences will soon extend beyond digital channels to reshape in-person banking. Several institutions are testing AI systems that brief branch personnel on likely customer needs before appointments.

Embedded finance—financial services integrated directly into non-financial platforms—will rely heavily on AI to provide contextual recommendations at precisely the right moment in the customer journey.

The financial AI revolution waits for no one. While your competitors implement AI solutions today, the opportunity cost of delay grows exponentially. Now is the critical moment to transform your financial services with AI.

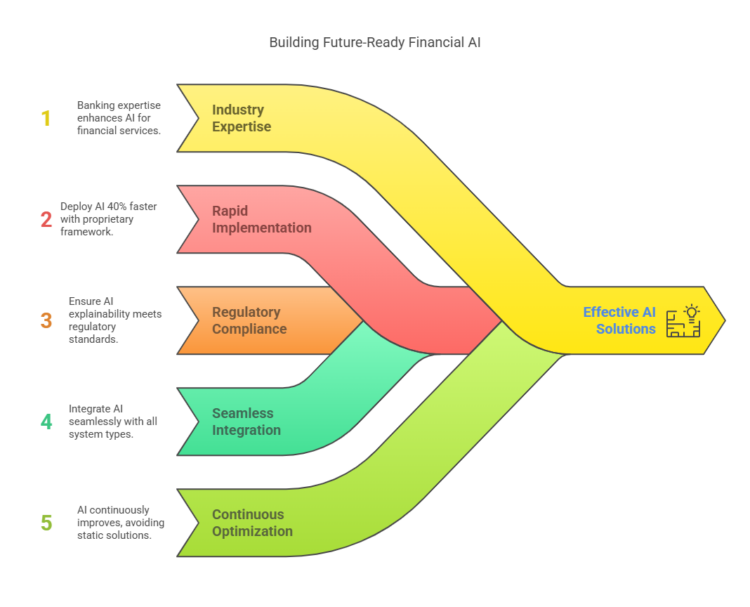

As leaders in AI-driven transformation, we bring specialized expertise to financial innovation. Our team has successfully deployed AI solutions for banks, investment firms, and fintech disruptors globally.

Our financial AI implementations deliver:

Schedule a personalized AI assessment with our financial technology experts. We’ll identify high-impact opportunities and create an implementation roadmap aligned with your strategic objectives.

Transform how you serve customers, manage risk, and drive profitability with Code Brew’s expertise backing your innovation journey.