The traditional financial firms are undergoing digitalization with steady technological developments. FinTech has made Financial Industry more promising, reliable and robust by optimizing costs and enhancing the quality of Financial App Development service which will eventually give us a better financial ecosystem. The early adopters of technology are experiencing a significant impact. To be competitive with the FinTech, financial firms need to transform now. The 2008 financial crisis led to FinTech innovations comprising of efinance, internet, social networking and analytics. FinTech startups started making a niche for themselves by offering data-driven solutions, innovative work culture and personalized services which differentiated them from traditional firms. Over the time, huge financial firms started collaborating with FinTech startups. In 2016, global investment in FinTech reached $5.3 billion. To gain a competitive edge, financial firms are investing heavily in FinTech startups. FinTech is not in its early stage now, rather it has a strong foothold which means the enterprises that are still working traditionally need to adopt this disruption before it is too late.

Table of Content

FinTech Ecosystem comprises of different elements that contribute to innovation, competition and collaboration in the finance sector.

FinTech Startups are the innovators of finance, so in the center of the ecosystem. The fintech companies are disrupting the entire diversified finance industry. Modern day customers are more convenient in reaching out to different niche specific startups for their financial needs. For example, customers will use Sofi for loans, PayPal for managing payments and some other app for managing stocks etc. Observing the huge change in customer behavior, venture capitalists have started investing huge amounts in FinTech startups. Then, there are technology developers who provide the tech platform to transform Finance to FinTech. Tech solutions like big data analytics, cloud solutions, artificial learning, mobile solutions, web solutions and social media help in creating a suitable environment for firms to sell their services in a personalized tech manner. Robo-advisors are making their way to offer wealth management services at lower rates. Social Media plays a key role in crowdfunding community growth and P2P lending services. Governments have been providing a favorable financial regulations and legislation for FinTech after the 2008 crisis. This enables fintech startups to provide more customized, inexpensive, and easy-to-access financial services to consumers as compared to traditional financial institutions. FinTech Startups rely majorly on financial customers for their revenue generation. Large enterprises also generate considerable revenues but the primary revenue source for Fintech are financial customers and SMEs. Looking at the favorable future demographics of FinTech, traditional institutions have started modifying their business model with new tech strategies derived from FinTech. All these elements contribute to benefit of customers in financial industry.

Depending upon the diversification of Finance Sector, there are six main business models of FinTech. This section will elaborate on how these models are different from each other in terms of value propositions, operating mechanisms etc.

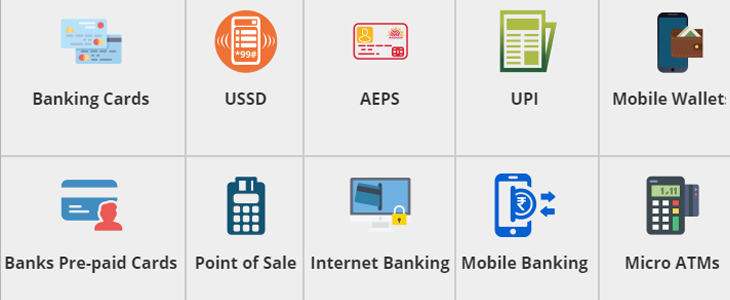

This is the least complex model that involves digital payments at lower costs. Payment Business Model is the fastest to be adapted among other models. The primary reasons are simplicity, lower costs and instant transaction activity. Customers these days seek for convenient solutions. Thus, they do not mind being disloyal to a firm because the new one has more convenience to offer. That being said, new payment options have enables customers to make real-time payments, and transfer currency internationally. Mobile Wallets have become popular and people do not mind using the virtual currency (often termed as cashback) because that facilitates them to buy more products without spending extra. Payment FinTechs cater to two markets:

Customer and Retail Payments

Wholesale and Corporate Payments

Retail sector uses payment services on daily basis and there are not many regulations for it. Thus, customers are becoming dependent on digital payment methods for their day to day shopping and other needs.

Wealth Management Model automates wealth financial advisory with its robo-Advisors that work according to algorithms that comes up with a suggestion including the right mix of assets on the basis of customer’s investment preferences. Robo-advisors are chosen over real-life advisors because of the huge cost-cutting. Customers can literally get the best of the finance advice by spending just a few bucks. Transparent fee structure, automated services and low investment minimums make wealth management fintechs successful in this particular niches.

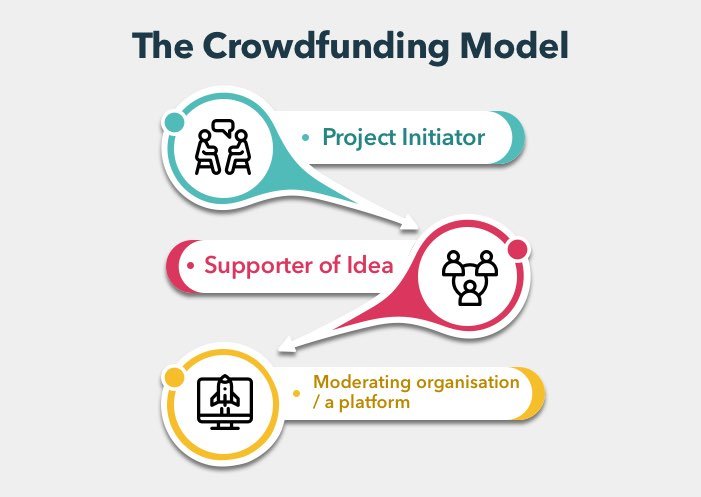

There are three parties involved in crowdfunding model:

Project Initiator: The one who needs funding

Supporter of Idea: Contributors who will support the project

Moderating Organisation: Facilitator between Supporter and Initiator

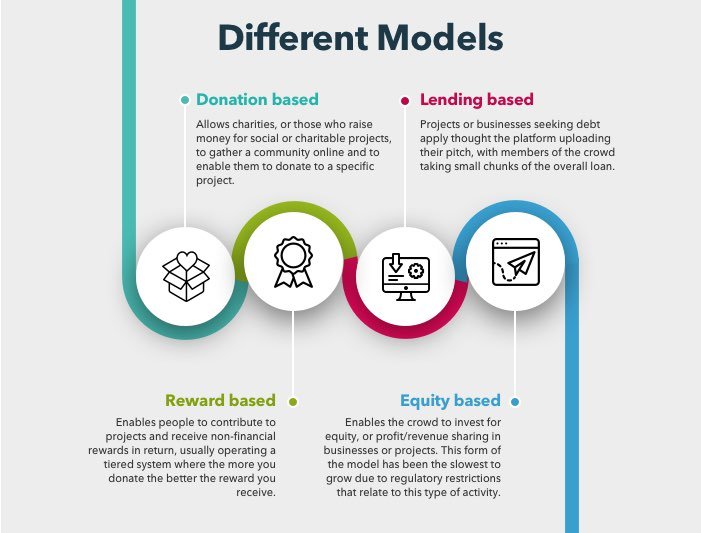

In this model, moderating organization lets the supporters to access all the data about different initiatives and funding opportunities for development of products and services. Crowdfunding model can further have different types of models such as rewards-based crowdfunding, donation-based crowdfunding, and equity-based crowdfunding (there are many but these are the three most popular ones).

Small and creative projects get most of their funding from rewards-based crowdfunding model. It is simple and interesting way where the supporters get some type of reward in return of the funds provided to the initiator. Donation-based is basically a model apt for charity projects in which the supporters (donors) contribute money without getting anything in return (except the credits, if the project becomes successful). In case of Equity based crowdfunding, the supporters invest with an aim to earn out of the project. It is best suited for SMEs but has a lot of regulations, thus is quite slow in growth terms.

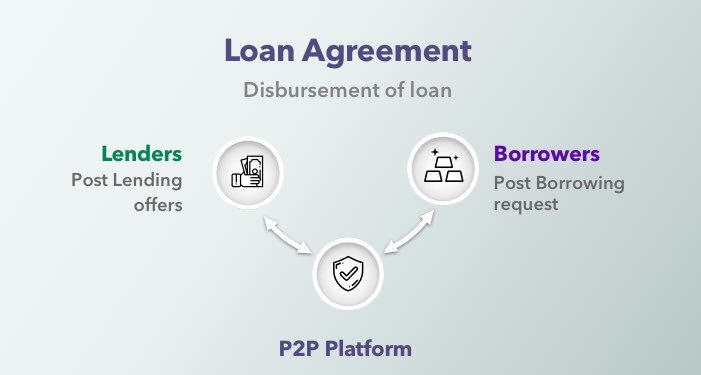

Another big trend in FinTech is P2P lending. It can be Peer-to-Peer customer lending or Peer-to-Peer business lending depending upon the parties involved in it. Individuals or organizations can borrow or lend money between each other. People often opt this over loans because of low interest rates and direct lending process. FinTech companies do not provide the money themselves but they connect the right lenders with the right borrowers by charging a small fee. Pretty simple and fair.

Fintech business startups are taking over every capital market area such as investment, foreign exchange, trading, risk management and research. The most promising of all is trading. Trading FinTechs help different investors and traders connect with each other to share knowledge, buy and sell commodities and monitor real-time risks. The other best performing FinTech area in capital market is foreign currency transactions. This area had been dominated by financial institutions. However with the advent of FinTech companies, costs have become minimum for individuals and enterprises to perform foreign currency transactions. It enables users to see all the live pricing and send/receive money in different currencies via their mobile devices securely. Using the popular payment methods, FinTech businesses are able to achieve this at much lower costs than traditional financial institutions.

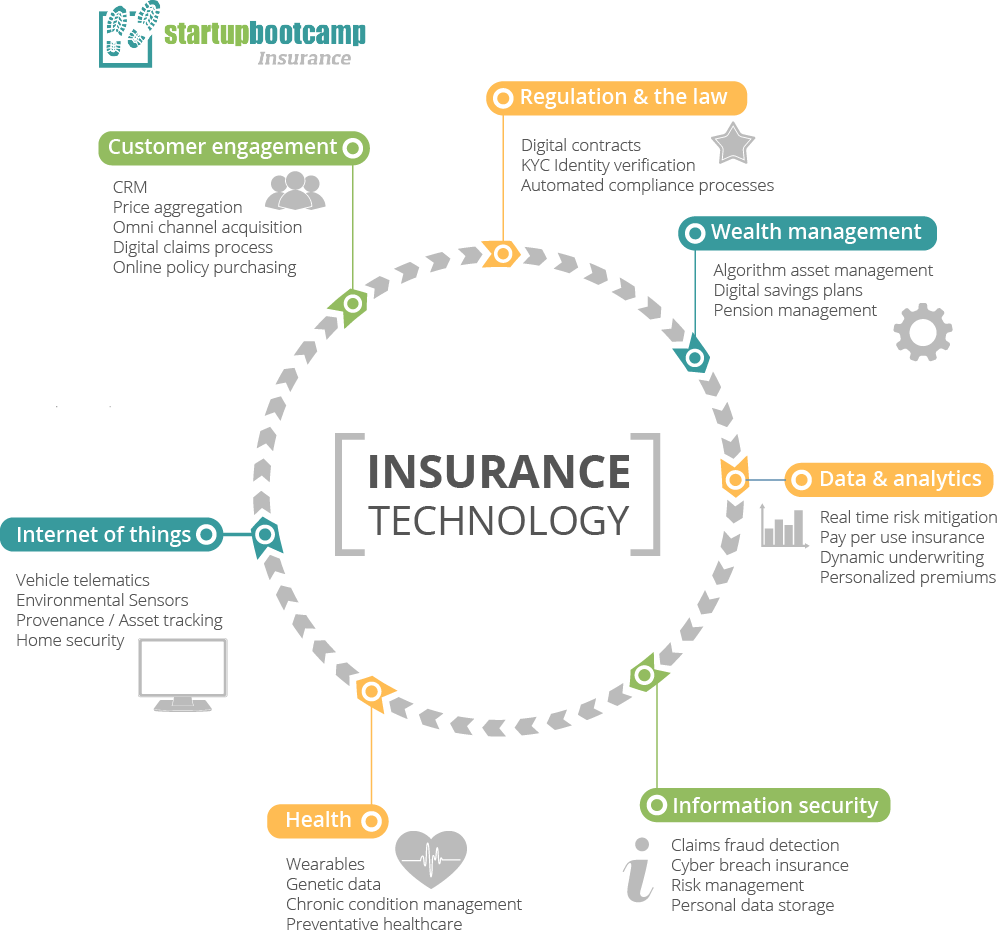

InsureTech is another business model that is being accepted by customers at a large scale. A direct relationship between customer and insurer is established in simple steps. Data Analytics are used for calculation and matching of risk. Customers can avail services to meet their insurance needs. Traditional insurance providers have embraced this model willingly as they are able to expand their data collection and improve their risk analysis at the same time.

The biggest users of FinTech are going to be the millennials. Millennials have become too demanding because they are continuously sharing knowledge with each other over the social platforms. They prefer services delivered at their doorsteps as and when required by them. With the change in customer preferences and behavior, traditional banks will have to digitalise using the right technology. FinTech companies have the advantage over traditional companies as they can offer personalized services that are tailor-made just the way the millennials want it.