Blockchain is a technology that allows fast, secure and transparent peer-to-peer transfer of digital goods including money and intellectual property. In cryptocoin [ Bitcoin, the first decentralized cryptocurrency that was released in early 2009. Similar digital currencies have crept into the worldwide market since then, including a fork from Bitcoin called Bitcoin Cash.] mining and investing, it’s an important topic to understand.

Table of Content

With a blockchain, many people can write entries into a record of information, and a community of users can control how the record of information is amended and updated. Likewise, Wikipedia entries are not the product of a single publisher. No one person controls the information.

“The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.”

Don & Alex Tapscott, authors Blockchain Revolution (2016)

People use the term ‘blockchain technology’ to mean different things, and it can be confusing. Sometimes they are talking about The Bitcoin Blockchain, sometimes it’s The Ethereum Blockchain . Most of the time though, they are talking about distributed ledgers, i.e. a list of transactions that is replicated across a number of computers, rather than being stored at a central server.

The common themes seem to be a data store which:

There are three principal technologies that combine to create a blockchain. These technologies are:

1) Private key cryptography

2) Distributed network with a shared ledger

3) Incentive to service the network’s transactions, record-keeping and security.

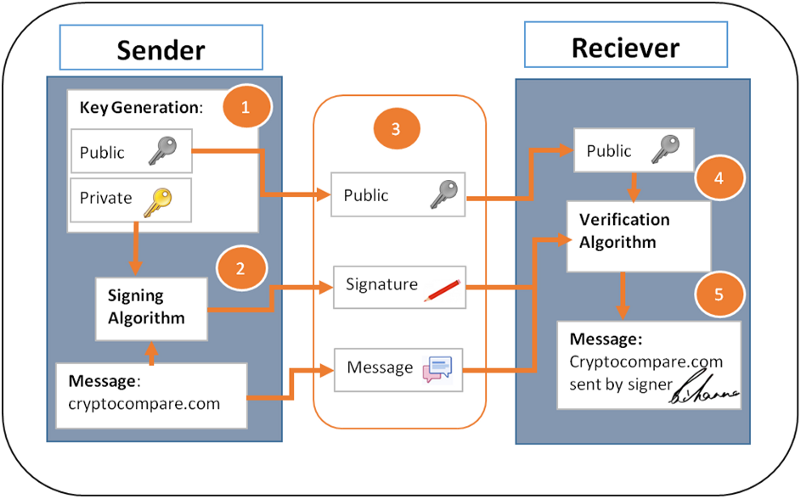

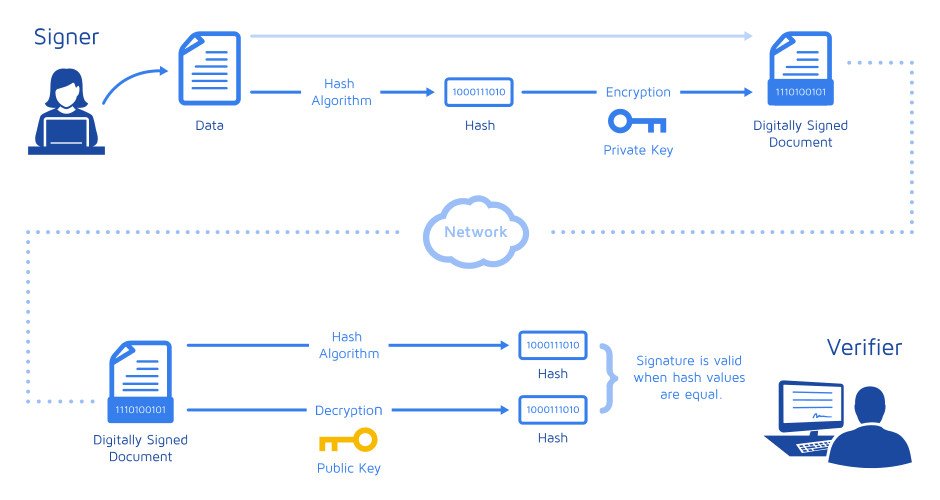

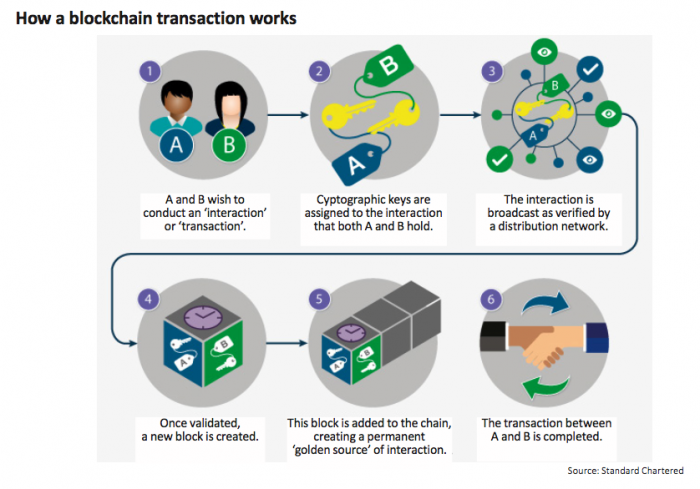

Two persons want to proceed with one to one transaction. Both of them have private and public key. To create a secure transaction a signature is created i.e. the combination of PUBLIC key and PRIVATE key. This signature is then used for authentication .

After authentication (includes all permissions and transaction approval), everything is handled by distributed networks. In this network we have validators which keep an eye on every minor detail, and are in the form of mathematical verifications. After authentication the cryptographic keys are combined with this network.

When cryptographic keys are combined with this network, a super useful form of digital interactions emerges. The process begins with A taking their private key, making an announcement of some sort — in the case of bitcoin, that you are sending a sum of the cryptocurrency — and attach it to B’s public key.

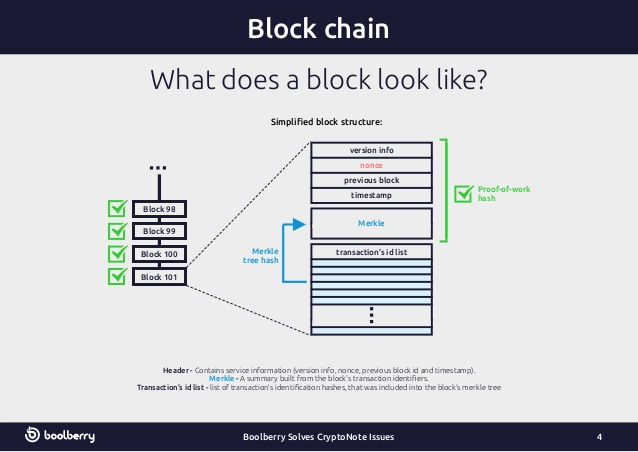

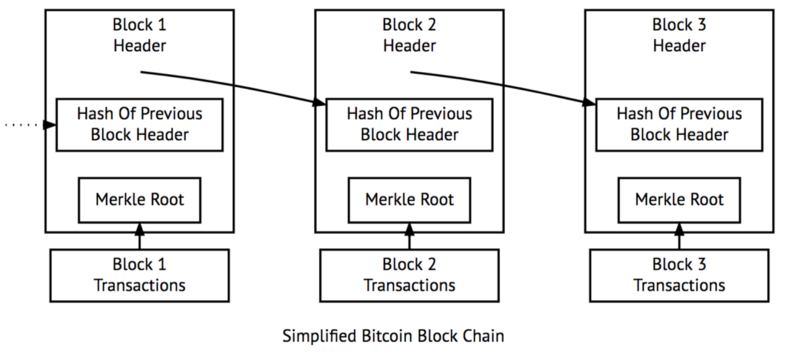

The process begins with A taking their private key, making an announcement and attach it to B’s public key. Then the whole combination turns into a block. A block contains — History hash, digital signature (combination of signer’s private key and verifier’s public key), time stamp and other information.

Then this block is broadcasted in the network.

These blocks are then attached with the chain of another blocks. The type, amount and verification can be different for each blockchain. It is a matter of the blockchain’s protocol — or rules for what is and what is not a valid transaction, or a valid creation of a new block. The process of verification can be tailored for each blockchain. Any needed rules and incentives can be created when enough nodes arrive at a consensus on how transactions ought to be verified. Blocks in a blockchain are attached liked this:

— Users are in control of all their information and transactions.

— Data is consistent, accurate and widely available.

— Due to decentralized network , blockchain does not have a central point of failure.

— Since all transactions, in the form of blocks are added to single public ledger, it reduces complexity.

— Reduction in transaction fees.

— Faster transactions (as bank can take days for clearing all the formalities and authentications)

— Every transaction requires signature verification (Because in centralized database once a connection has been established, it is used for further transactions. But here we have decentralized system)

— There is a high barrier to entry to become a Node, encouraging a larger amount of centralization in the network, with bigger players being able to take more control.

— There is one notable security flaw in bitcoin and other blockchains: if more than half of the computers working as nodes to service the network tell a lie, the lie will become the truth. This is called a ‘51% attack’ and was highlighted by Satoshi Nakamoto when he launched bitcoin.