In light of the recent evolution in the Fintech mobile application development, the entire scenario to build a Fintech app has become a core necessity for sectors like finance & banking, credit companies, stock/ investment firms, insurance companies, business owners, and entrepreneurs.

Table of Content

The Fintech sector is one of the fastest-growing and most compelling areas that offer digitalization convenience for best banking practices.

Fintech emanated by merging Finance with Technology, which consists of a single platform where everything can happen in a single go. For instance, transferring/ crediting money in real-time by replacing traditional mediums of payments to avail services across multiple finance domains.

The growth of custom fintech app development services is highly regarded and considerable due to the aspects associated with the digital financial world.

It is evident how fastly technology has superseded all industries and the finance sector is no exception. As per the report by Adroit Market Research, the fintech market is all set to hit $699.50 USD billion at a CAGR of 20.5 by 2030.

Seeing such a highly leveraged sector, custom fintech app development gives businesses more boost to develop mobile apps to offer banking and other financial institutions a room of freedom from conventional modes of operations.

It tends to offer consumers highly reliable security and convenience and makes banking accessible to people across the globe.

If you are thinking to develop a Fintech app, this article will interest you about the various types of fintech solutions, the essential requirements for the fintech market, as well as the cost of financial app development. Keep reading to discover more!

Artificial Intelligence and Machine Learning are shaping the face of the financial software development services market. To a surprise, more companies are including these automated technologies in developing a Fintech app that provides customized user insights. It helps users to make informed decisions about their money and shows them their spending history.

The primary purpose of developing a Fintech app is to help users solve financial issues efficiently and create an intuitive interface with increased functionality and useful tools to make hassle-free financial transactions.

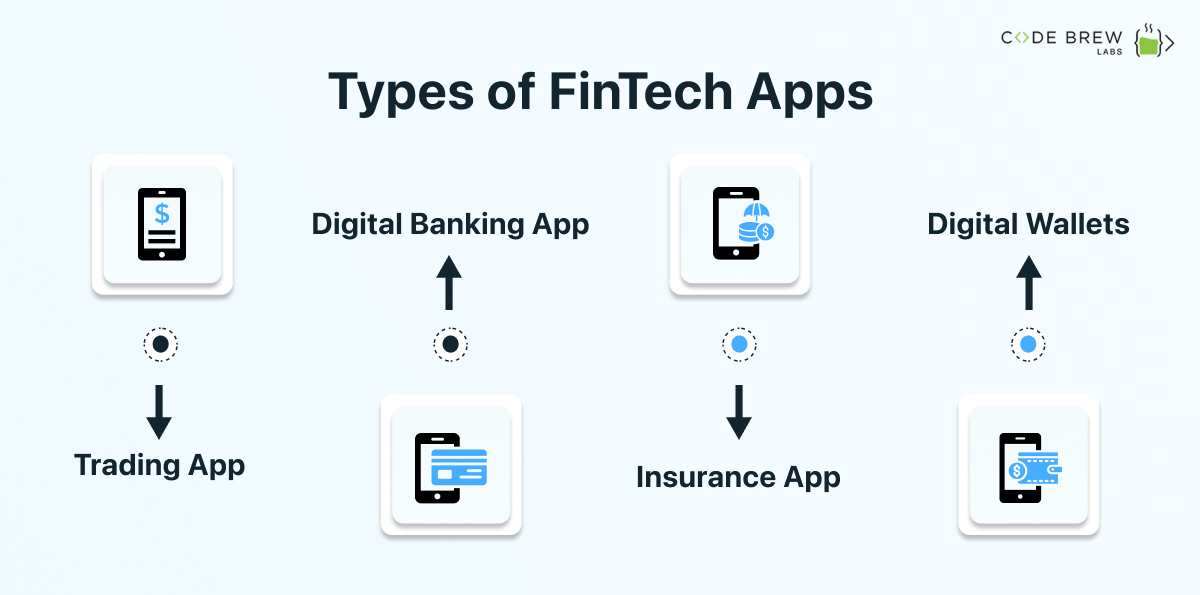

In the FinTech business, entrepreneurs can choose from numerous financial apps, from wealth management platforms to digital banking solutions. All you need to do is to consider your business requirements, define the target audience, and here you go.

Let’s talk about the main types of FinTech applications that businesses can build!

Trading App

Trading applications enable a smooth investment and trade directly from the app without any interruption from intermediaries such as middlemen or brokers. This type of FinTech app development usually works on forex, stock, and capital markets.

Digital Banking App

The overall role of digital banking apps is to bring closer interactions with banking institutions online. Customers may virtually carry out any banking-related tasks, such as opening an account, transferring funds, or making loans, using this software.

Insurance App

Insurance applications enable digital insurance are tend to facilitate and expedite insurance policy issuance. The app helps to handle consumer claims and minimize fraud rates. As a result, a more streamlined interaction between customers and insurance agents takes place that ensures a best-in-class service to the users.

Digital Wallets

A digital wallet is a personal app that allows users to reserve their funds, and make adequate transfers, in addition to payment receiving. A good example of such a digital wallet is the most popular – Apple Wallet.

Here are the features that your mobile app must have in 2023 to offer validation and are easily categorized for each user panel on the app dashboard.

The application enables users to easily register on the Fintech app which doesn’t need account registration.

Login without registration becomes easier with the two-factor authentication method or users can even do it effortlessly through touch/face ID. To ensure the security of your fintech app, you’ll want to consider using SSL/TLS encryption for all data transfers, implementing two-factor authentication, and using OAuth for user authorization.

Brands can leverage personalization in terms of display in the dashboard such as font size, color theme, and set out the list of features for each user.

Through this feature, users can manage their money such as e-wallets, net banking, debit & credit cards, and monitor their funds in the savings accounts. They can easily send and receive payments through their preferred mode of payment.

Sending alerts and reminders to the users can be integrated as an additional feature to let them stay updated on credits and debits of their accounts.

With constant notifications, users will be able to stay updated about different offers, changes in payment, discounts, reduced prices, etcetera.

Integrate multiple payment gateways so the users would not find any difficulty in making payments on the app. To enable secure payment transactions, you can use a payment gateway like Stripe, PayPal, or Braintree.

This particular feature allows users to do hassle-free payments simply by scanning the QR code and transferring money as many times as they want.

Code Brew Labs is the leading provider of Web development, Mobile App development, and consulting solutions. It is the next global leader in offering mobile applications and digital solutions.

Our IT mavens have been developing fintech apps with deep knowledge of this industry. Coupled with our vast practical experience and industry intelligence in hand, we make a perfect win-win solution for any aspiring SMBs, or enterprises who are looking to make a debut in the financial services market by launching a fintech app.

When creating a fintech app, you’ll need to consider a tech stack that can handle sensitive financial information, secure transactions, and ensure fast processing times. Here are some technologies you may want to consider:

The minimum cost to build a custom FinTech application that offers customers a secure and convenient online transaction method could be $40,000 which takes around 3-4 months for development.

Here are some estimates of the costs involved:

On the other hand, you could spend somewhere between $30,000 and $50,000 creating a banking application with a basic user experience and functionality. You may spend somewhere between $60,000 and $100,000 incorporating modern technologies and improved solutions into a FinTech app. A very sophisticated and custom-rich financial app can cost you up to $250,000.

The custom Fintech app development has completely changed the look & feel of money inflow and outflow which in return has revolutionized the financial services industry as a whole. Ultimately, it has greatly contributed to turning it into becoming a multi-billion dollar sector optimizing automated technology.

FinTech is a steadily growing industry towards the transformation of the conventional financial system into a digitally-operated funds platform. Developing a fintech app development solution will bring the financial world map out the distance closely and perfectly.

Got interested? Drop us a line and we’re just a message away!